- Solo Founders

- Posts

- A Tesla exec goes solo, the SaaS selloff, and are VC-backed startups low status now?

A Tesla exec goes solo, the SaaS selloff, and are VC-backed startups low status now?

The internet's hottest project wasn't built in SF, a Tesla exec went solo, and everyone's asking if AI is killing SaaS. Let's get into it.

VC-Backed Startups are Low Status?

In his new essay, Michael Dempsey (Managing Partner at Compound VC) argues the VC-backed startup path is becoming what investment banking was: the obvious move for ambitious people, which is exactly why it’s losing status.

He makes a key distinction:

“This is not about all founders. It is not about the person who has been doing research on something their whole life and tries to solve previously unsolvable science. It is not about the person who cares deeply about how their technology is used (in reality, not just in a deck). It is not about the person who treats running a company as a serious responsibility rather than a right they fell into. These people exist and they will continue to exist and inspire many daily.”

That's most of you. Solo founders tend to be more like this — less drawn to status, more focused on the problem. Starting solo already goes against Valley consensus, so you're self-selecting out of the default path.

Yesterday, 900 people RSVP'd to an event in San Francisco. The line stretched down the street. People tried to bribe their way inside. When the main floor filled, they opened a spillover floor with a livestream.

They were all there to see Peter Steinberger, the creator of OpenClaw (formerly Clawdbot) — the fastest-growing open source project ever, now past 168K GitHub stars.

Here's the thing: Peter built OpenClaw solo while splitting his time between Vienna and London.

The internet's hottest project wasn't born in the Bay Area. It was born thousands of miles away by a solo founder.

Peter isn't an anomaly. Jan Oberhauser started n8n as a side project in Berlin — no co-founder, no Bay Area network. Today it's valued at $2.5B. Dhravya Shah built Supermemory from his dorm room in Arizona before joining SFP.

The Bay Area has real advantages — serendipity is denser, and in-person relationships hit different. But being outside SF can also keep you focused on customers instead of chasing clout.

We break down what the data shows and what to do if you're not in SF.

Read the full post.

He led Tesla's used car division, then had a kid and decided to become a solo founder

Jimmy Douglas didn't run a formal fundraise for Plug. He spent a year building a relationship with Floodgate through what he calls "a process of ideation"—meeting every few months to kick ideas around together.

“It wasn't me showing up with conviction, pitching them on funding a company. It was us mutually kicking a soccer ball around the concept of used EVs.”

By the time they put a term sheet down, both sides already believed. No formal process needed.

We sat down with Jimmy to hear the full story—including his unfiltered take on solo founder equity: he says solos can afford to be more generous because they start with twice as much. But when I asked if his dilution matched co-founded peers, he said: "We've taken on way more."

Read the full story.

Solo Launches: Security for Vibe Coders + 10x better memory for Claude Code

Vibe coding is giving founders insane building speed. Titan launched this week to make sure that speed doesn’t compromise security.

Built by Ananay Arora (SFP F25), Titan scans your codebase for vulnerabilities, explains what’s wrong, and generates the fix. Prior to starting Titan, Ananay won security bounties from Facebook, Perplexity, and the Department of Homeland Security and built apple-auth and passport-apple which have a total of 8.63 million NPM downloads.

Separately, Dhravya Shah (SFP S25) shipped v2 of Supermemory for Claude Code — shared context across teammates and agents in real time, better config options, and fewer tokens used. The repo has surpassed 2,000 stars in under a week.

Is AI Killing B2B SaaS?

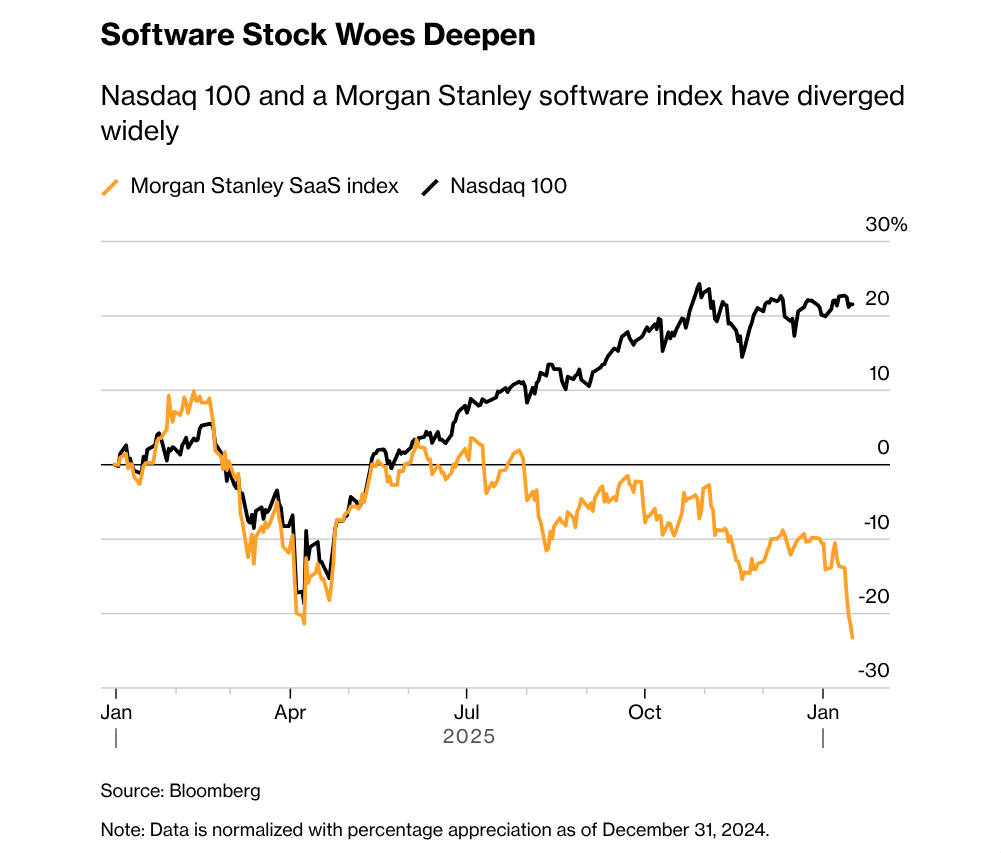

Traders are dumping software stocks as fears of AI disruption increase.

I’ve been reading a lot about this lately and wanted to share what’s been most useful as I try to make sense of it, especially for those of you building SaaS.

Ben Thompson's commentary on the topic was excellent.

"That, then, raises the most obvious bear case for any software company: why pay for software when you can just ask AI to write your own application, perfectly suited to your needs? Is software going to be a total commodity and a non-viable business model in the future?

I'm skeptical..."

Ben argues most companies don't want to be in the business of building and maintaining software—they want products, not code. Support, compliance, integrations, ongoing maintenance—that's what they're paying for.

"Still, that doesn't mean the code isn't being written by AI: it's the software companies themselves that will be the biggest beneficiaries of and users of AI for writing code. In other words, on this narrow question of AI-written code, I would contend that software companies are not losers, but rather winners: they will be able to write more code more efficiently and quickly."

He also made nuanced points about SaaS pricing and positioning. I recommend setting aside some time to read the entire thing (~7 min read).

I also thought Namanyay Goel’s (SFP S25) latest piece had interesting insights on what SaaS customers want next: more flexibility and customization.

"The times of asking customers to change how they work are gone. Now, SaaS vendors that differentiate by being ultra customizable win the hearts of customers."

More to come, but AI is clearly changing how SaaS companies need to operate.

Thanks for reading. If you enjoyed, please spread the word and forward this to a friend who might find it useful.

Solo, together.

— Kieran, Julian, & The Solo Founders Team